It’s important to remember that tax laws can be complex and are subject to change. Consulting with a tax professional can help you understand your specific situation and ensure you’re taking advantage of all available deductions and credits. It’s worth noting that residents of New York City and Yonkers also have to pay local income taxes, in addition to the state income tax. These local taxes can further affect the overall tax burden for individuals living in these areas.

Household tax credit

Taxpayers can then reduce their New York adjusted gross income by subtracting the higher of the New York standard deduction or New York itemized deductions. New York itemized deductions generally conform to federal itemized deductions as they existed prior to enactment of Public Law ; however, certain modifications, such as an add-back for income taxes, apply. In addition, an overall New York State deduction limitation applies to upper-income taxpayers. New York taxpayers may also subtract from New York adjusted gross income a $1,000 exemption for each dependent, not including the taxpayer and spouse. After computing taxable income, taxpayers apply a marginal tax rate schedule to compute their tax before credit amount.

Understanding Tax Brackets

Signed into law by Governor Kathy Hochul on May 9, 2025, the New York State budget 2025 includes significant tax changes with implications for businesses and individuals. The 2023 tax rates and thresholds for both the New York State Tax Tables and Federal Tax Tables are comprehensively integrated into the New York Tax Calculator for 2023. This tool is freely available and is designed to help you accurately estimate your 2024 tax return. The 2021 tax rates and thresholds for both the New York State Tax Tables and Federal Tax Tables are comprehensively integrated into the New York Tax Calculator for 2021. This tool is freely available and is designed to help you accurately estimate your 2022 tax return. If you live in New York City or Yonkers, you may have to pay local income taxes in addition to state taxes.

Services

- For example, if you’re in the 25% tax bracket, that doesn’t mean you pay 25% on all of your income.

- If you need extra help, connect with a local TurboTax expert for professional advice or to have them file for you.

- If this exceeds your New York State tax liability, you are eligible for a refund.

- Descriptions of tax credits available under multiple tax articles are contained in the Cross-article tax credits section of the report.

- If you’re looking for a streamlined solution, TaxLasso offers the perfect balance—affordable DIY options with professional expertise, saving you time and money.

- Tax-Rates.org provides easy access to five of the most commonly used New York income tax forms, in downloadable PDF format.

If you’re ready to find an advisor who can help you achieve your financial goals, get started now. By leveraging TaxLasso, Houston homeowners can navigate local tax differences and recent law changes efficiently, saving both time and money. For tax years beginning on or after January 1, 2023, the Empire State child credit is expanded to include children under the age of 4. The federal standard deduction for a Head of Household Filer in 2023 is $ 20,800.00.

- This would reduce rates for joint filers making up to $323,200 and for single filers making up to $215,400.

- If you are contacted about the inflation refund check by someone supposedly from the Tax Department, report it.

- New York State’s top marginal income tax rate of 10.9% is one of the highest in the country, but very few taxpayers pay that amount.

- Similarly, the city sales tax adds to the cost of goods and services you purchase.

- Another way to manipulate the size of your paycheck – and save on taxes in the process – is to increase your contributions to employer-sponsored retirement accounts like a 401(k) or 403(b).

- Whether you’re a homeowner in Houston managing property in NY or a resident navigating the latest tax updates, staying informed is key to avoiding penalties and maximizing savings.

- Meanwhile, New York City also levies its own income taxes, which means residents of the Big Apple pay some of the nation’s highest local rates.

By using TaxLasso, you can tackle NY tax issues efficiently and cost-effectively, ensuring you pay only what you owe. TaxLasso is the ideal middle ground, offering affordability, expertise, and efficiency. Whether you’re protesting your property valuation nys income tax rates or planning for NYS tax obligations, TaxLasso ensures you’re prepared for 2025. The decoupling from the federal changes have resulted in the creation of a new tax expenditure at the state level for the subtraction of moving expenses/moving expense reimbursements. The standard deduction for a Head of Household Filer in New York for 2023 is $ 8,000.00. The standard deduction for a Head of Household Filer in New York for 2021 is $ 8,000.00.

- Calculating your New York State income tax can seem daunting, but you can simplify the process with a tax calculator.

- These digital tools are designed to navigate the complexities of tax calculations, saving you both time and potential errors.

- Let’s delve into the specific tax brackets to see how this progressive system is structured.

- With careful planning and the right strategies, you can ensure that you’re prepared for tax filing season and make the most of your income.

- They can also help you see how different deductions or credits might affect your total tax bill.

- To learn more about this scam and how to verify a phone call from a Tax Department employee, see Current tax scams and alerts.

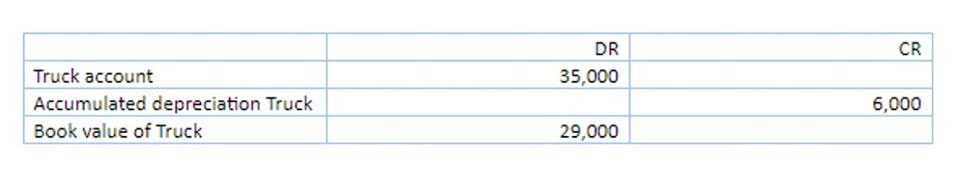

The Earned Income Tax Credit (EITC) is a significant tax credit in the United States, designed primarily to benefit working individuals and families with low to moderate income. As a refundable credit, the EITC not only reduces the amount of tax owed but can also result in a refund if the credit exceeds the taxpayer’s total tax liability. This makes the EITC a powerful tool for reducing poverty, incentivizing work, and providing financial support to those who need it most. The credit amount varies based on the taxpayer’s income, marital status, and number of qualifying children, with the intention of providing greater assistance to families with children. The Tax tables below include the tax rates, thresholds and allowances included in the New York Tax Calculator 2025. Credits are amounts which may be subtracted from the individual’s computed state tax liability.

State Income Tax Brackets

New York requires you to eFile if you use eFile-enabled software to process your return and you have an Internet connection. Over 90% of New York taxpayers file online, and New York state law prevents any tax preparer for charging an extra fee to eFile your tax return. By leveraging these credits, deductions, and exemptions, Houston homeowners can save significantly. For property tax challenges, TaxLasso simplifies the process, ensuring you https://www.rtpgroupengineering.com/what-is-a-classified-balance-sheet-a-detailed-2/ get the best results without the hassle.

What are the deadlines for filing New York State income tax?

When you prepare and eFile your Tax Return the eFile Tax App will apply the correct standard deductions for you or you can apply the itemized deduction method. To claim deductions, you need to meet certain eligibility criteria and fill out the correct forms when you file your taxes. There are a ton of online tools that can make figuring out your taxes easier. The New York State Department of Taxation and Finance has its own set of calculators to help you estimate your tax liability, figure out your estimated taxes, and more.

- This update provides a clear summary of what has changed, who is affected, when these changes take effect, what actions are required, and what these developments mean for pending and future tax filings.

- For the 2024 tax year (filed in 2025), the NYC tax rates range from 3.078% to 3.876%.

- Taxpayers must subtract the amount of household credit used to reduce tax liability from the earned income credit.

- Also, the inflation refund credit is designed to return a total of $2 billion to over 8 million New Yorkers.

- Whether you’re a resident or non-resident, being aware of these rates can help you manage your finances more effectively and prevent any unwelcome surprises when tax season rolls around.

A relative, boy- or girlfriend, family member, or other person might qualify as an Other Dependent on your tax return. Not sure if your child or an other person will qualify to be a dependent on your tax return? The New York State Department of Taxation and Finance is your go-to place for everything tax-related. Their website has all the forms, instructions, and publications you could need.

The tax is applied to wages, salaries, and other compensation within certain thresholds, which are adjusted periodically. The distinct components of FICA, namely Social Security and Medicare, each have specific rates and caps that determine the amount of tax levied. As such, FICA represents a critical element of the United States’ approach to social welfare, providing foundational financial security and healthcare benefits that many Americans rely Retail Accounting on. New York’s maximum marginal income tax rate is the 1st highest in the United States, ranking directly below New York’s %. You can learn more about how the New York income tax compares to other states’ income taxes by visiting our map of income taxes by state.